forex retracement strategy

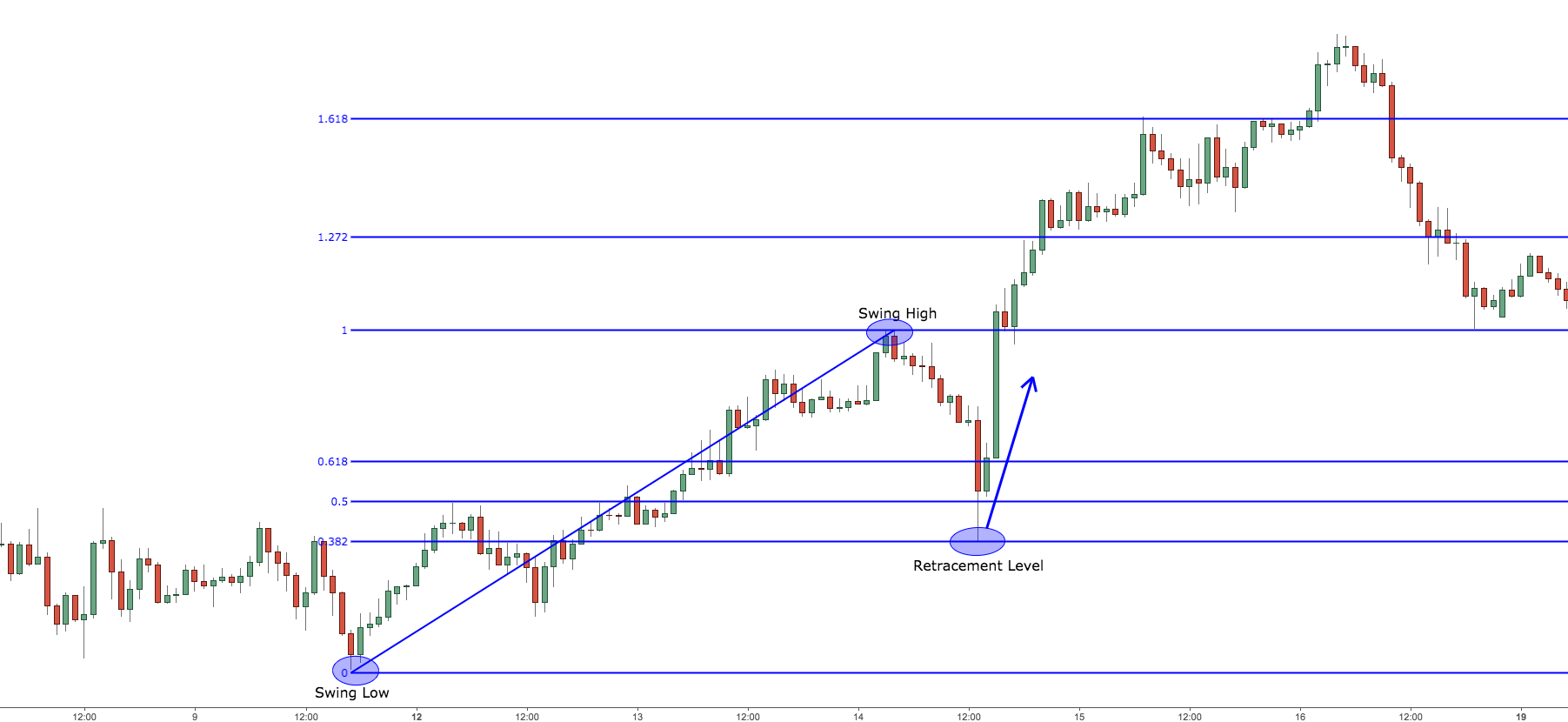

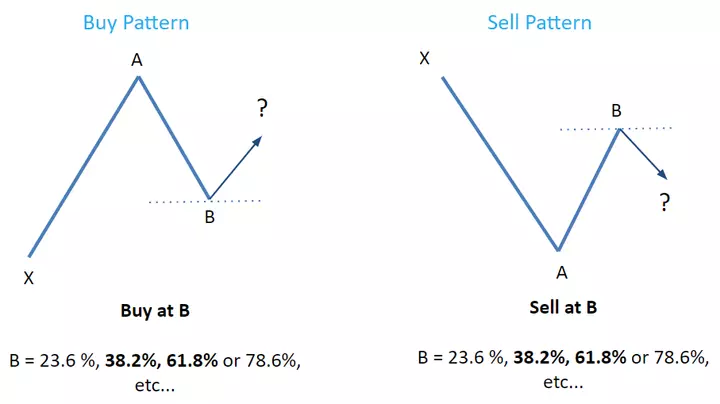

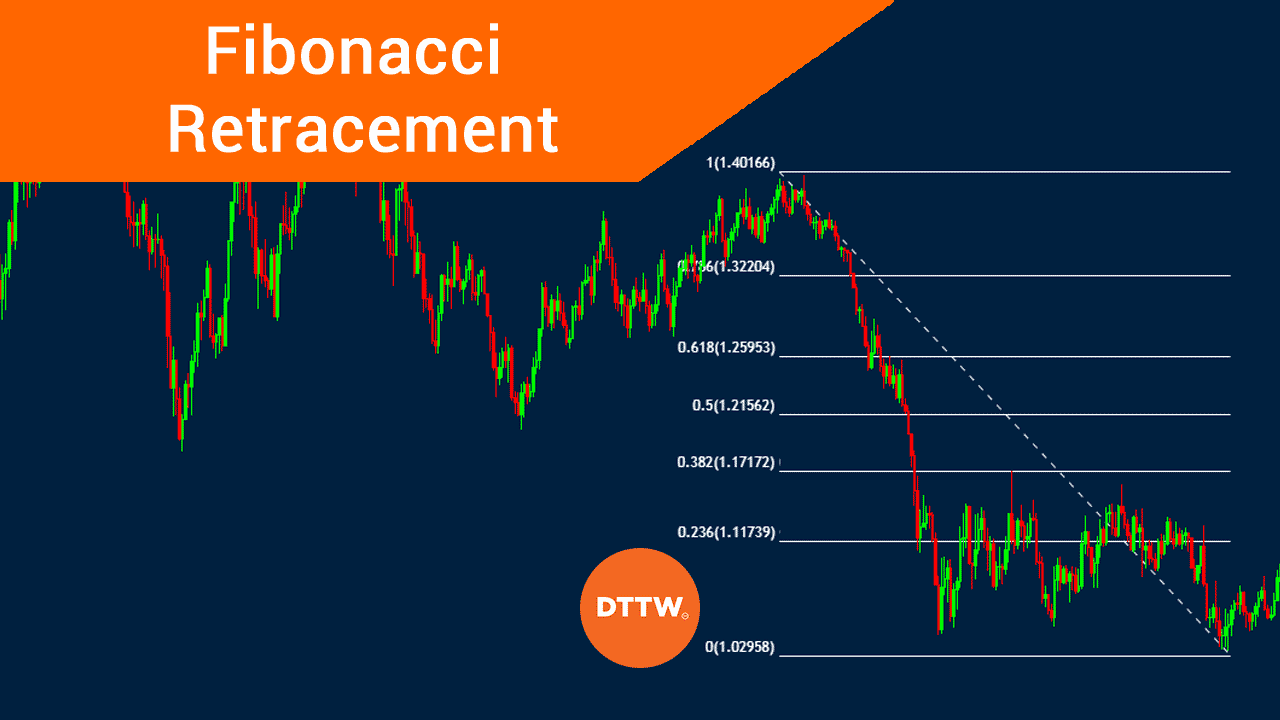

These levels are based on Fibonacci levels. In Forex and other technical analysis trading a Fibonacci retracement is obtained by taking two extreme points usually a swing high and a swing low on a currency stock or commodity.

Using Fibonacci Retracement Levels With Price Action Daily Price Action

However it also waits for retracements in order to get a better.

. Fibonacci retracement is a method of technical analysis that uses the ratio of Fibonacci numbers to project the levels between the extreme points on financial charts. The strategy allows traders to buy and sell pairs. While Fibonacci retracement identifies levels that prices will retrace to Fibonacci extension projects the direction of the move a price is likely to make in future.

Tremendous Pattern Retracement Foreign exchange Buying and selling Technique supplies a possibility to detect varied peculiarities and patterns in value dynamics that are. Retracement entries allow for the convenient placement of a stop loss. Below you will find out how 13th-century math principles help to benefit modern traders and.

Have you heard of the Fibonacci trading technique. Rules for Fibonacci Trading System. If not heres a handy little guide for you.

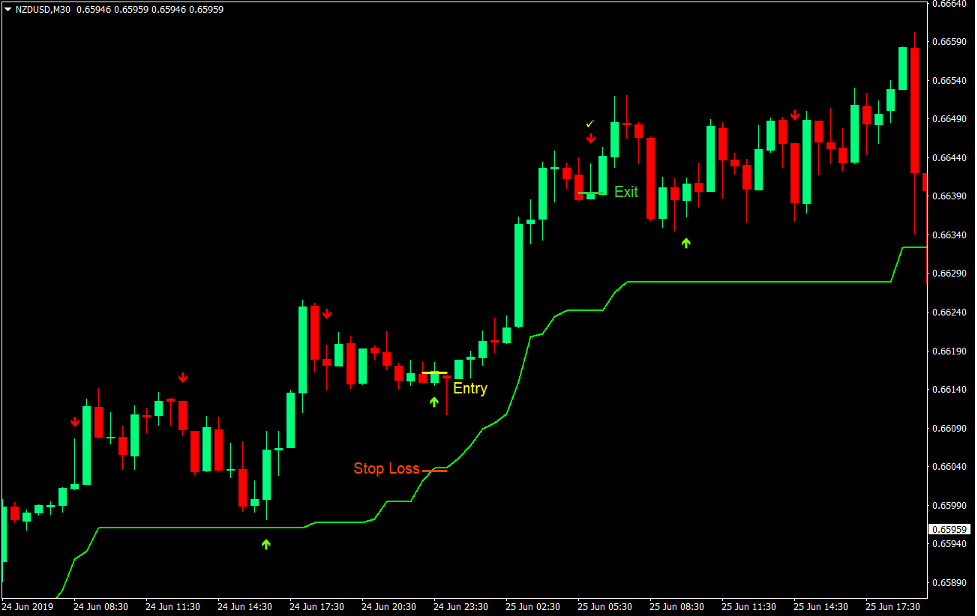

The first one should be a tight stop loss below the 50 retracement point while the one below the 67 retracement point can be set more liberally ensuring that your account. Super Trend Retracement Forex Trading Strategy is a strategy that is a combination of a trend-following strategy and an average reversal strategy. Stochastic Mean Retracement Forex Trading Strategy is a trend following strategy that trades retracements towards the mathematical mean of a forex pairs price.

Sometimes when the chart price is in. Other reasons why retracement trading is a good strategy include. The Forex retracement strategy for beginners follows the prevailing market trend and is based on two popular Fibonacci retracements levels.

The Forex 618 Fibonacci Forex Trading Strategy is a whole Fibonacci trading system based on the 618 Fibonacci Retracement level. Stop and Go Retracement Forex Trading Strategy is a strategy that trades in a trending market condition. The Fibonacci indicator will show you exactly where to enter a trade where to.

Squeeze Break Retracement Forex Trading Strategy provides an opportunity to detect various peculiarities and patterns in price dynamics which are invisible to the naked eye. Exit and where to put a stop loss.

Forex Fibonacci Strategy For Daytraders

Super Trend Retracement Forex Trading Strategy Forexmt4indicators Com

Best Methods Of Using Auto Fibonacci Retracement Trading System With Oscillator Indicators Forex Online Trading

Using Fibonacci Retracement Levels To Find Support And Resistance Forex Training Group

Trend Retracement Or Reversal Babypips Com

Using Fibonacci Retracement Levels To Find Support And Resistance Forex Training Group

Fibonacci Retracement Extension Trading Strategies

Highly Profitable Fibonacci Retracement Strategy For Daytrading Crypto Forex Stocks Youtube In 2022 Fibonacci Strategies Forex

Fibonacci Retracement Strategy Paxforex

Fibonacci Retracement Strategy For Beginners

Fibonacci Indicator Retracement Trading Strategy Great For Traders Investing And Trading In Forex Stocks Penny Sto Fibonacci Fibonacci Art Technical Analysis

Fibonacci Forex Trading The Numbers That Lead To A Strategy

Pin Bar Forex Trading Strategy The 50 Retracement Myth 2nd Skies Trading

Fibonacci Retracement And Extension Basics Fx Day Job

Why Every Forex Traders Should Learn Fibonacci Retracements

Fibonacci Trading Strategy Full Verdict Asiaforexmentor

Best Forex Trading Strategy Simple Forex Trading Fibonacci Retracement Trading Lesson 9 Forexmarketview

Can You Use Fibonacci As A Leading Indicator

The Fibonacci Retracement A Must Have Tool In Day Trading Dttw